Events and Reports

29 Mar 2023

Articles16 March 2023

Broadcast Disruptors Bulletin: what you need to know today about the shifting sports media landscape

If you haven’t already, sign up for free to receive the bulletin straight to your inbox every second Thursday.

Bulletin length: 1,494 words – it’s a 7-minute read

Short form

Leaders Broadcast Disruptor of the week: João Pedro Paes Leme

Enter our awards; join us in India

Boxing’s thriving online platforms

Epic Games ups creator payouts

Sports media production in 2030

Broadcast market SWOT analysis: South Africa

Long form

LEADERS BROADCAST DISRUPTOR OF THE WEEK

Who? João Pedro Paes Leme

What? Founding Partner, Play9

Why? Leme, a former Rede Globo executive, runs the Play9 digital agency with Brazilian streamer Felipe Neto. Its latest project last week saw legendary Brazilian sports broadcaster Galvão Bueno launch his own YouTube channel, Canal GB, in order to broadcast a livestream of Brazil’s friendly match with Morocco. 72-year old Bueno has been the voice of many of Brazil’s most significant sporting moments, including World Cup victories, Ayrton Senna’s F1 world championships and Senna’s death in 1994. When Globo, his usual employer, pulled out of bidding for Brazil’s latest international, Play9 secured a deal with the Brazilian Football Association to stream the game in the country. Bueno’s first livestream generated over 10 million views, with a peak of 1.5 million. Impressive numbers, particularly, as Leme has pointed out – comparing Bueno to Neto or Casimiro, another Brazilian streamer now regularly broadcasting games via his channels – as this might be the first example of a non-digital native, non-athlete streaming live sport via their own YouTube channel. In an instant, a new way for Brazilians to hear a reassuringly familiar voice.

THE BIG PICTURE

Thanks for your click and hi from us; this is the Broadcast Disruptors Bulletin – it’s a fortnightly briefing on how sports content is created, produced, packaged up, sold and distributed, and you’re very welcome to it.

A last call to enter the Leaders Sports Awards. Deadline day is tomorrow. An all-star group of judges is waiting to deliver its verdict on your best work.

And first word of our latest Leaders event – happening in a thriving and fascinating media market. We’re heading to Bangalore – the Silicon Valley of India, no less – in June, for Leaders Meet: Innovation – India. It’s all in partnership with IPL franchise Royal Challengers Bangalore; there’ll be a strong turnout of all the key decision-makers and decision-takers in Indian sport, and we anticipate it being a really powerful way of learning more about a market that simply can’t be ignored. Dates for your diary: 28th and 29th June. Drop us a line for more info or have a look here.

In spite of a recent Outlook update, we are still available to receive your emails – send news, views, gossip and intelligence our way at [email protected] and [email protected].

THE TICKER

NWSL launches global streaming service with Endeavor // DAZN launches channel on Sky // DAZN and Sky to share UK IPL rights // Willow secures North American ICC rights // Web3 firm Rug Radio launches sports strand // Argentinian government confirms FTA national team games // Felix Loesner joins Bayer Leverkusen // De Marchis to advise BuzzMyVideos and Cleeng // Osborne promoted to Head of Women’s Sport at Sky // USTA seals WBD deal in France // Veritone extends with Augusta National // Disney shuts Next Generation Storytelling division

EYES ON THIS – Watch how these things develop to understand the future

On the box: Anthony Joshua, former world heavyweight champion and DAZN investor, returns to the ring on Saturday in London for a heavyweight fight with Jermaine Franklin. It’s the first time since 2015 that a Joshua fight won’t be on pay-per-view, a combination of how his stock has recently fallen and his decision to move from Sky to DAZN, which is making Saturday’s card available as part of its subscription. DAZN has, over the past fortnight, struck deals with Sky and Virgin Media to carry its service – notably, DAZN now has its own channel on Sky. And the fight week build-up, well underway as you read this, serves as another reminder that boxing media is like no other, in terms of the way the business of the sport – how fights are made, who’s paying what to whom, pricepoints for subscriptions, ticket sales – is reported on, discussed and lapped up by a willing audience. In particular, promoters like Matchroom’s Eddie Hearn are regularly delivering more traffic to online boxing channels like IFL TV, Boxing Social, Boxing King Media and Behind the Gloves than fighters. In giving these non-traditional channels access, Hearn also has platforms willing to offer him almost unlimited time to land messages to fighters, other promoters and of course promote big fight nights and Matchroom’s global DAZN partnership – all to significant numbers of hardcore boxing fans. It’s a major time commitment, clearly, but perhaps a way of operating that other executives in other sports might want to start considering when their views are being regularly sought.

Creative control: Incentivising and remunerating creators continues to be a big issue for all sorts of digital platforms, and gaming appears to be the latest sector grappling with how to pay creators more, but within the confines of a workable business model. In what seems a substantial move, Epic Games, the company behind Fortnite, has announced it will share 40% of its total revenues with creators who design ‘islands’ within the game. The move was announced in conjunction with the launch of the latest iteration of Epic’s Unreal Engine editor, which will for the first time allow user generated projects to be published directly into the Fortnite game. According to Epic Games, ‘Fortnite is becoming an ecosystem’, with the company adding that ‘means new tools to design, develop and publish games, and a new economy that rewards developers’. It continued: ‘These updates bring us one step closer to Epic’s vision of a connected metaverse with billions of players enjoying high-quality creations made by millions of developers’. Payment will be determined by the popularity of the ‘islands’. According to Telecrunch, around half of play time in Fortnite happens in user-created content. Fortnite is following Roblox in formalising creator payouts – the latter paid out US$600 million to creators last year, with some estimates now suggesting that Epic may end up shelling out US$1 billion in the same way.

THE NUMBERS

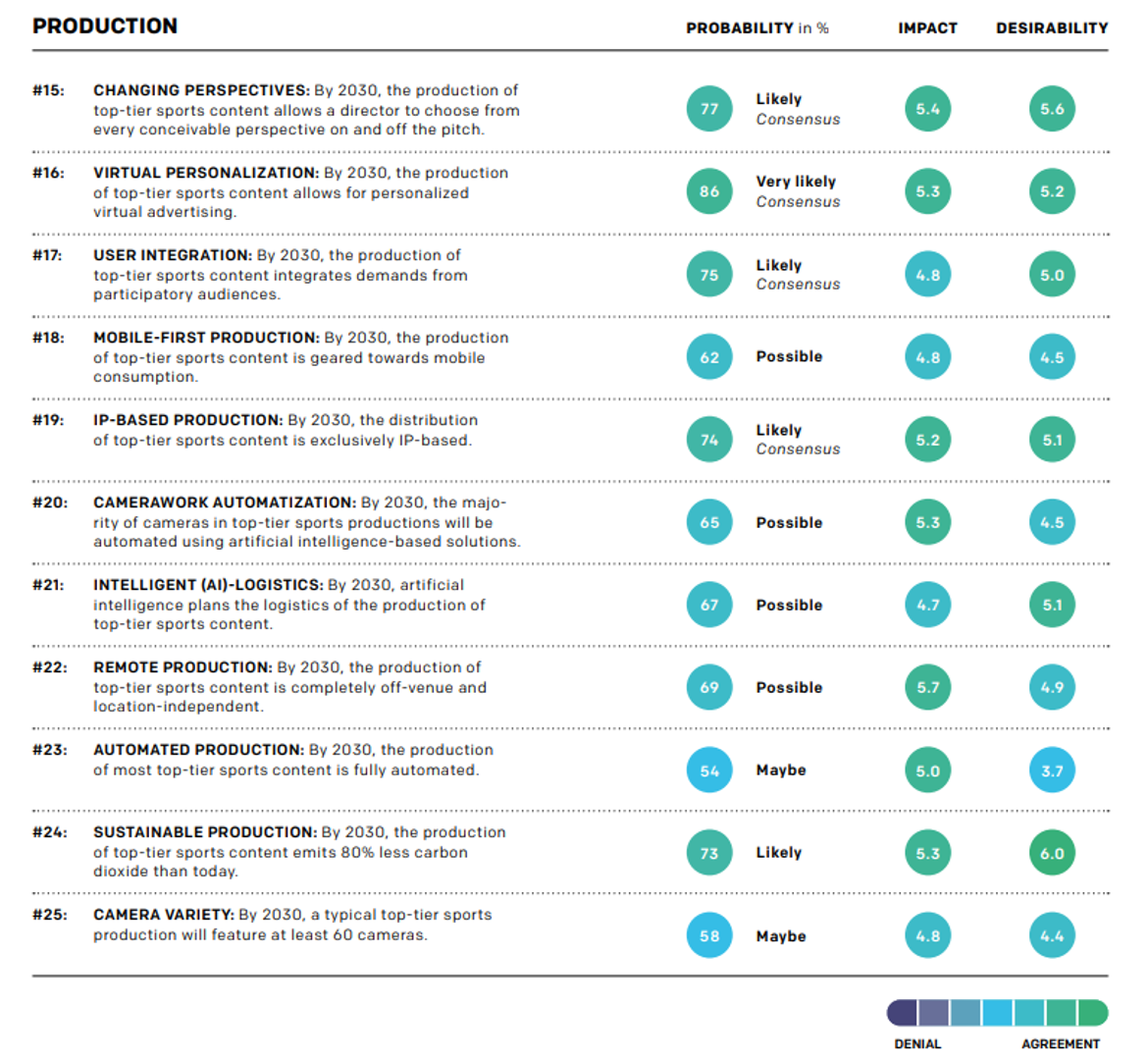

The WHU-Otto Beisheim School of Management, supported by the DFL, the organisation that runs the Bundesliga, and Amazon Web Services, has produced a new report that gathers 99 sports media perspectives, from producers, clubs, leagues, tech firms and broadcasters, to predict what media production in sport will look like in 2030. The panelists were asked about the likelihood, desirability and impact of 25 different areas of the industry – a selection of results (impact and desirability scores out of 7) below.

Source: CSM research report: Top-tier sports product and its production in 2030v.

~

~

Source: CSM research report: Top-tier sports product and its production in 2030

BROADCAST MARKET SWOT ANALYSIS

South Africa… by Capitalize Media CEO, Kelvin Watt, who rates SuperSport CEO Marc Jury as the best broadcast executive in the market.

Strengths

Weaknesses

Opportunities

Threats

Thanks for reading this edition of the Broadcast Disruptors Bulletin. If you haven’t subscribed yet, do remember to opt-in here.

Events and Reports

11 May 2023 • Report

Leaders Report – WOW! Moments: Making an Impact with Major Events within Major Events

29 Nov 2022 • Report

Leaders Report – What’s an app worth today? Making decisions about digital that optimise ROI

22 Sep 2022 • Report

Leaders Report – Data Engines: The numbers, systems and services driving sport’s next generation technology

17 Feb 2022 • Report

Leaders Special Report – Transformation Journeys: Strategic Approaches to Digital in 2022

17 Dec 2021 • Report

How to maximise the value of branded content in 2022

4 Oct 2021 • Report

Leaders Special Report – Women’s sport: bouncing back from the pandemic

1 Oct 2021 • Report

Leaders Special Report – ‘Owning the fans’: What does it really mean?

17 Aug 2021 • Report

Leaders Special Report – The super aggregators: sports IP pirates have gone OTT

14 Jul 2021 • Report

Leaders Special Report: Enabling digital transformation in sport

14 Dec 2020 • Report

Leaders Special Report: Building a better normal

1 Oct 2020 • Report

Leaders Special Report: Activating Digital

24 Apr 2020 • Report

Leaders Special Report: Sport and gamification

Related articles

18 May 2023 • Article

Broadcast Disruptors Bulletin: IMG’s production base; the art of football analysis; and what Linda Yaccarino’s new job means for sport

27 Apr 2023 • Article

Broadcast Disruptors Bulletin: LFP Media’s transformative hires; Italy’s sports broadcast market analysed; and does women’s sport coverage need more controversy?

27 Mar 2023 • Article

Leaders in Sport lands in India as they announce partnership with world-renowned IPL Franchise, Royal Challengers Bangalore

17 Mar 2023 • Article

Broadcast Disruptors Bulletin: Serie A, Premiership Rugby and why we might need to talk about Reddit

23 Feb 2023 • Article

Broadcast Disruptors Bulletin: Apple, animation and the Bundesliga’s VAR broadcast plan

10 Feb 2023 • Article

Broadcast Disruptors Bulletin: Serie A and the Bundesliga contemplate media rights investments; what 78.9% of us are doing on TikTok; and why the Atlanta Falcons built a TV studio

31 Jan 2023 • Article

Diversity Series: Welcome to 2023

27 Jan 2023 • Article

Broadcast Disruptors Bulletin: Defining the metaverse; Roblox’s self-assessment; and the NBA-Meta expansion explained

12 Jan 2023 • Article

Broadcast Disruptors Bulletin: Questions to be answered in 2023; some ChatGPT perspective; and how to broadcast the biggest race in esports

29 Nov 2022 • Article

The Leaders Sport Business Summit Abu Dhabi Returns for 2023

28 Jul 2022 • Article

Broadcast Disruptors Bulletin: How Sky Sports builds rights holder relationships; FanDuel plans for a ‘watch and wager’ network; and picking over the launch of NFL+

24 Jun 2022 • Article

Broadcast Disruptors Bulletin: Why sport should look at original scripted programming; the ICC view on India’s thriving media market; and what happens now MLS has sold its global rights