Events and Reports

27 Jan 2023

Articles27 January 2023

Broadcast Disruptors Bulletin: what you need to know today about the shifting sports media landscape

If you haven’t already, sign up for free to receive the bulletin straight to your inbox every second Thursday.

Bulletin length: 2,146 words – it’s a 9-minute read

Short form

Broadcast Disruptors of the Week: Kelly Burgett and Alex Drymonakos

Defining the metaverse; figuring out interoperability

Roblox by the numbers

The NBA, Meta, VR and alternative content

Explaining the dip in football club broadcast revenues

Formula E’s Chief Media Officer Aarti Dabas

Long form

LEADERS BROADCAST DISRUPTOR OF THE WEEK

Who? Kelly Burgett and Alex Drymonakos

What? Co-Founders of Audience Labs, a new sports marketing agency launched this week

Why? Burgett and Drymonakas are bringing their experience of working for Red Bull to bear with the launch of a new agency specialising in content strategy, media monitoring, audience research and media sponsorship valuation. They’re entering a crowded section of the industry, but believe they have hit on a fresh approach – an alternative to the ‘fancy dashboard, full team of analysts and data engineering team’ offered by others. Burgett, who worked in Red Bull’s Global Audience Insights department, and Drymonakos, who was in the sports marketing team, are launching with another former Red Bull executive. Sharon Fuller will Chair Audience Labs’ Advisory Board, alongside her own new role as Head of Content and Social for NBA Europe and Middle East, which she takes up next month.

THE BIG PICTURE

Thanks for opening the email and spending the next few minutes with us. This is the Broadcast Disruptors Bulletin, a fortnightly snapshot of tidbits, trends and tasty morsels from the world of sports media, content creation and broadcasting.

We’re at [email protected] and [email protected], where we’re also anxiously awaiting your news, intelligence, opinion and best industry speculation.

And we’re not the only ones organising stuff. Our friends at Grabyo have two events lined up – they’ll be in Melbourne on 2nd February and, back in London, offering a behind-the-scenes tour of a live, multi-camera production (plus canapes) on 23rd February.

THE TICKER

WBD to lay-off BT Sport staff // Whisper signs up as Wimbledon partner // Telemundo scores US Soccer deal // Falcons open Ticketmaster Studios // LIV secures CW broadcast deal // Reed Hastings to exit Netflix role // DAZN signs Amazon distribution partnership // YouTube tests FAST model hub // Viacom18 wins Women’s IPL rights // Vicente to chair all-star SportTotal advisory board // CBS orders more pickleball // Content chief Ostroff leaves Spotify

EYES ON THIS – Watch how these things develop to understand the future

Walk WEF me: As the snowfall settles on the annual gathering of the great, good and elite in Davos, work under the banner of the World Economic Forum is continuing on the complex task of defining the parameters of the metaverse. WEF has been gauging the views of a host of metaverse experts, amongst them Animoca Brands’ CEO Robby Yung, in an effort to help crystalise a universal approach and creative actionable strategies around metaverse governance, safety – and, essentially, how on earth the idea of interoperability, the ability to move digital goods or profiles seamlessly from platform to platform, can and should become the norm. An initial working group paper, published last week to coincide with Davos, identified three areas of interoperability where best practice and governance needs consideration: technical, usage and jurisdictional. The technical area is examining topics including network constraints, asset ownership, IP protections, payments, identity verification and data privacy and security; usage interoperability topics include inclusive design, respecting different cultures and practices, as well as design fit for use across all demographics; and the jurisdictional interoperability area includes focuses on data compliance, how transactions are created and occur within metaverses, accountability and identity frameworks. The working group is continuing to meet regularly and its initial interoperability briefing paper is available here – its ultimate recommendations, short, medium and long-term, will undoubtedly impact how sports organisations think about and create future content, products and experiences.

Roblox up ahead: “2022 was a great year for Roblox,” was the predictably upbeat start to CEO David Baszucki’s annual review letter. The platform’s numbers appear more than healthy: a 23% uplift in users over the year, to a total of 56 million; perhaps more surprisingly, especially to parents, over half of those users are now 13 or older. As sport continues to explore the emerging Roblox world, his note is well worth reviewing in full here, but Baszucki’s letter touched on several areas of particular progress over the last 12 months. One such was its focus on the creative expression of self, through its launch of its Layered Clothing feature, which allows for garments to be draped in the same way they would be in real life. Similarly, the company reported over a million ‘Roblox experiences’ using its voice chat function, which replicates in-person conversations by basing volume on proximity (whisper if your avatar’s close by, but you’ll need to shout if it’s all the way over there). The platform is also working on its creator tools: no surprise when developers and creators published over 15,000 experiences on Roblox every day last year. The company’s Roblox Studio and Roblox Cloud offerings have both been refined, while a Creator Hub, a central reservoir of information and tools, was formed at the end of the year. Roblox is also focusing on immersive adverts, in addition to the over 100 brand activations launched in 2022 (it’s noteworthy that the NFL, which launched the NFL Tycoon experience on Roblox last February, is one of the few brands Baszucki mentioned by name). “As companies continue to establish themselves on Roblox, with the help of our community, the opportunities for creators increase,” he concluded. “And the growth of our community expands the opportunities for organisations to connect with their audiences on Roblox. We’re excited to see this momentum continue.”

Net worth: The NBA’s all-in-one destination app is the current go-to example if you ask any sports content or media executive what they’re currently admiring/jealous of – and no surprise, it’s superb (and, having, imitated the likes of Instagram and Snapchat with its Stories feature, it now seems to be setting a trend for other sports events and leagues; it’s noticeable that the latest version of the Australian Open’s official app has also gone down the ‘Stories’ vertical video route). But the league is continuing to innovate elsewhere when it comes to delivering content in fresh ways; in the week it launched its latest alternative broadcast, available within the aforementioned app, featuring former player-turned-broadcaster Bill Walton and guests from sport, literature and business (Nike founder Phil Knight featured on Monday’s broadcast), the NBA has also expanded its virtual reality partnership with Meta. In the new deal, 52 live NBA games, plus selected games from the WNBA, NBA G League and NBA 2K League, will be available via MetaQuest, Meta’s VR headset, this season. The live games are available within XStadium, Meta’s VR hub for sport in the US, and Meta Horizon Worlds. Plans include five ‘immersive 180-degree monoscopic VR games in 2880 resolution featuring celebrity broadcasters’, as Meta and the NBA look to combine the new viewing experience with the concept of alternative broadcasts.

THE NUMBERS

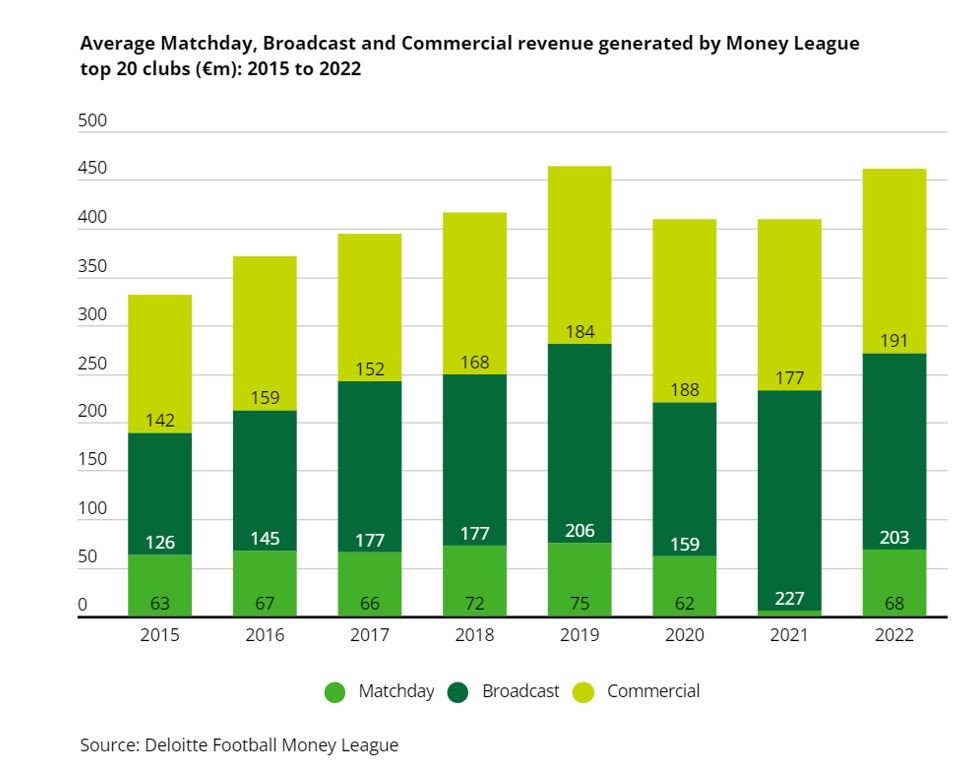

The Deloitte Football Money League is a sports industry staple – and Manchester City’s ascension to the top of the charts generated plenty of headlines last week. Beyond the ranking, however, the report provides useful historical analysis of the way in which broadcast revenues have sat alongside commercial and matchday revenues for the world’s biggest clubs. This year an increase in commercial revenue was offset by an 11% fall in broadcast revenue – as Deloitte explains, this is something of a reset ‘as the bumper year experienced in 2020/21, as a result of the deferrals of revenue relating to the postponed 2019/20 seasons being recognised in the financial year, was not repeated’.

PRODUCTION NOTES

In the Mixed Zone with…Aarti Dabas, Chief Media Officer, Formula E, who joined the electric motorsport series three years ago from the International Cricket Council. The next round of the new Formula E season takes place in Saudi Arabia this weekend.

You’ve been in post for nearly three years, how do you see role in terms of building and executing strategy?

I’ve started looking at my world in terms of seasons. I came from a sport, cricket, that wasn’t seasonal – that was World Cups and events, rather than seasons. And now I’ve done two full seasons. I joined in the midst of the pandemic. I joined after five successful seasons and especially the last season had seen massive growth and when I joined it was an inflection point for us as a sport: could we continue to grow at this pace, or how could we change tact, or adapt and build on what we’d done? When I joined the focus of the business was moving from serving the partner – because we are a very strong sponsorship business compared to other sports, and rightly so – to becoming a fan-facing, fan-first business. How do you attract more audiences and customers? That was vastly different to what I’d done previously where audiences existed and you had to build content and products and a distribution model to serve those audiences, and use that to create market competition. Here you had to do everything from scratch. It has been a journey, but really the first two seasons were setting the foundations – and hopefully the work that’s been done will now start to come to light in the next season.

What’s your approach when you join an organisation, with an existing mission, existing strategies? How do you decide what to change and how quickly to change?

It’s really important when you join an organisation that you’re really clear what is expected of you and in what timeframe. You need to go in with clarity on what strategy you’re serving, or are you resetting it? Equally, what’s important – and what I’ve realised in my two decades in the industry – is change is important, but respecting what was done earlier is also important. People have done something, built businesses and brought it to a certain extent. Irrespective of why you were hired, it’s really important to first go into a business to understand a business – what is the ecosystem, who are the stakeholders, what are the requirements? Only then can you build a strategy that builds on what was there. When I joined, I joined at a point when it was a reset of the media strategy – I was given that mission, but even to reset we had to build on what was done in the past because there was a stakeholder ecosystem that expected certain things. You couldn’t just go in and take it all out. I could write a great strategy on paper but without consulting the ecosystem and taking them on the journey is impossible.

If you’re responsible for media and distribution of content, how do you put forward wider ideas around how the product could innovate and change when it’s not squarely your remit?

Ultimately, what every sport or any product needs to do is diversify its revenues. You don’t want to be too dependent on one source. I would hope that even the biggest sports products or codes, who rely 90% or 95% on media rights, have a strategy – because that bubble may burst. Every sport has to be prepared for the future and the future is having a direct relationship with your fans. I’m not talking about setting up your own OTT, it’s about knowing that if you do not get the direct sponsorship value or direct broadcaster value you know you have this fanbase you can interact with directly and serve. You’re not at the behest of a big broadcaster/media house/sponsor. Where Formula E is as a business, it’s a partnerships-led business – it’s very different from the majority of global sports properties, where the majority of money, whether it’s 50% or more, comes from media. But rather than try to become one of those global sports properties, we can change the game here. Media doesn’t have to be 50% – even a 20% or 25% share can grow the business hugely, because that will grow the partnerships business. We are not trying to copy a traditional sports growth model; it’s can we build our own model for growth? What’s key for us – and for every organisation – is diversification. I come from a role where media rights was 80% or 85%, but here you have to take everything in; ultimately there is tension, but ultimately without tension you can’t achieve what you want to. Tension has to exist.

Aarti Dabas was talking in November on The Blueprint, the podcast about straightforward strategic thinking in sport, brought to you by Leaders and Deltatre.

Thanks for reading this edition of the Broadcast Disruptors Bulletin. We’ll have another for you a fortnight today; and if you haven’t subscribed yet, do remember to opt-in here.

Series Advisors:

Events and Reports

11 May 2023 • Report

Leaders Report – WOW! Moments: Making an Impact with Major Events within Major Events

29 Nov 2022 • Report

Leaders Report – What’s an app worth today? Making decisions about digital that optimise ROI

22 Sep 2022 • Report

Leaders Report – Data Engines: The numbers, systems and services driving sport’s next generation technology

17 Feb 2022 • Report

Leaders Special Report – Transformation Journeys: Strategic Approaches to Digital in 2022

17 Dec 2021 • Report

How to maximise the value of branded content in 2022

4 Oct 2021 • Report

Leaders Special Report – Women’s sport: bouncing back from the pandemic

1 Oct 2021 • Report

Leaders Special Report – ‘Owning the fans’: What does it really mean?

17 Aug 2021 • Report

Leaders Special Report – The super aggregators: sports IP pirates have gone OTT

14 Jul 2021 • Report

Leaders Special Report: Enabling digital transformation in sport

14 Dec 2020 • Report

Leaders Special Report: Building a better normal

1 Oct 2020 • Report

Leaders Special Report: Activating Digital

24 Apr 2020 • Report

Leaders Special Report: Sport and gamification

Related articles

18 May 2023 • Article

Broadcast Disruptors Bulletin: IMG’s production base; the art of football analysis; and what Linda Yaccarino’s new job means for sport

27 Apr 2023 • Article

Broadcast Disruptors Bulletin: LFP Media’s transformative hires; Italy’s sports broadcast market analysed; and does women’s sport coverage need more controversy?

29 Mar 2023 • Article

Broadcast Disruptors Bulletin: Brazil’s latest streaming sensation; how school sports is at the forefront of South Africa’s sports broadcast market; and why Fortnite just got a lot more interesting

27 Mar 2023 • Article

Leaders in Sport lands in India as they announce partnership with world-renowned IPL Franchise, Royal Challengers Bangalore

17 Mar 2023 • Article

Broadcast Disruptors Bulletin: Serie A, Premiership Rugby and why we might need to talk about Reddit

23 Feb 2023 • Article

Broadcast Disruptors Bulletin: Apple, animation and the Bundesliga’s VAR broadcast plan

10 Feb 2023 • Article

Broadcast Disruptors Bulletin: Serie A and the Bundesliga contemplate media rights investments; what 78.9% of us are doing on TikTok; and why the Atlanta Falcons built a TV studio

31 Jan 2023 • Article

Diversity Series: Welcome to 2023

12 Jan 2023 • Article

Broadcast Disruptors Bulletin: Questions to be answered in 2023; some ChatGPT perspective; and how to broadcast the biggest race in esports

29 Nov 2022 • Article

The Leaders Sport Business Summit Abu Dhabi Returns for 2023

28 Jul 2022 • Article

Broadcast Disruptors Bulletin: How Sky Sports builds rights holder relationships; FanDuel plans for a ‘watch and wager’ network; and picking over the launch of NFL+

24 Jun 2022 • Article

Broadcast Disruptors Bulletin: Why sport should look at original scripted programming; the ICC view on India’s thriving media market; and what happens now MLS has sold its global rights